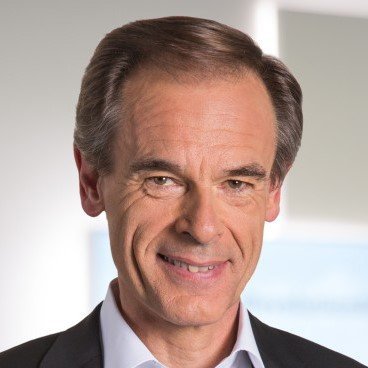

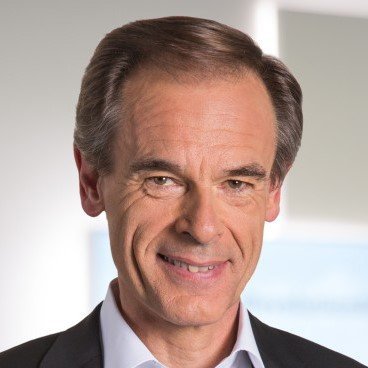

Chengguang Li holds the Chair of Strategic Management at the TUM School of Management, TUM Campus Heilbronn. He and his team conduct research on the strategy of multinational enterprises (MNEs), small and medium sized enterprises (SMEs), and family firms, with an emphasis on global strategy, firm reputation, and sustainability. His research has been published in the Strategic Management Journal, Journal of International Business Studies, Journal of Management, Journal of Management Studies, and Harvard Business Review and has been funded by the German Research Foundation (DFG).

Professor Li is initiator and host of the CEO Leadership Series at TUM Campus Heilbronn and president of TUMselect. He is Engagement and Practice Impact Editor at Management Science and has served on the editorial boards of the Journal of International Business Studies, Journal of Management Studies, and Global Strategy Journal.

Professor Li studied industrial engineering at the Technical University of Berlin and obtained a Master of Science from the Nanyang Technological University in Singapore and a Master of Engineering from the Massachusetts Institute of Technology (MIT). Prior to joining academia, he worked as a consultant at the Boston Consulting Group (BCG) and Roland Berger in Berlin, Dubai, and Munich.

Scientific staff

Scientific staff

Administrative staff

Alumni

The CEO Leadership Series is the flagship lecture series of the Technical University of Munich (TUM) and takes place at the Heilbronn campus.

The goal of the CEO Leadership Series is to bring together top executives and students. Each event features one executive, who participates in a panel discussion to talk about his/her career, life, and company, and respond to questions posed by students. This format allows students, early on, to obtain insights into the fascinating corporate world and the exciting life and work of highly successful and renowned managers.

The CEO Leadership Series was inaugurated by the former President of Germany and has featured executives from various companies, including public firms that are part of the AEX 25 (Netherlands), CAC 40 (France), DAX 40 (Germany), Dow Jones 30 (USA), and SMI 20 (Switzerland), among others.

Winter 2025/26

Winter 2025/26

Past semesters (A-M)

Past semester (N-Z)

TUMselect is a career network at the Technical University of Munich (TUM) for excellent Bachelor and Master students (and alumni) in management and information engineering.

The program selects our top students through a rigorous assessment center, and connects them with attractive partner companies. The goal of TUMselect is to offer these selected students additional support for their future careers through exclusive events, workshops, and mentoring in and around Heilbronn, Frankfurt, and Stuttgart.

TUMselect students have access to the TUMselect network. They can participate in exclusive events with our partner companies, take part in workshops, and receive mentoring.

If you would like to join the TUMselect network, please send your application to Monika (email), consisting of your CV, current grades, high school diploma/grades, and other certificates.

After your CV passes the initial screening stage, we will invite you to our assessment center, which takes place on different days within a two-week time span toward the end of every semester. During your full-day assessment center, you will:

1. Work on case studies

2. Solve brainteasers

3. Take a quantitative, written test

4. Discuss current business news

5. Talk about your CV

We look forward to receiving your application!

The TUMselect partner companies are amongst the most renowned and aspiring firms in their industries, such as automotive, consumer goods, investment banking, software, and strategy consulting, among others.

More importantly, TUMselect partner companies highly value human capital and frequently offer particularly ambitious, interesting, and rewarding jobs. Thus, partner companies of TUMselect regularly look for excellent students with strong academic records, impressive CVs, and pleasant personalities, and they go the extra mile to attract these talents.

Please reach out to Ms. Monika Liu (email) if your company is interested in TUMselect.

A. For students

1. Grades: What are the minimum grade requirements?

There are no minimum requirements, since grades are only one (albeit an important) aspect.

That said, the average grade of our current TUMselect students easily falls well within the top 5-10 percent of the entire TUM student body.

2. Semester: When can I apply for TUMselect?

Students from every semester may apply.

However, an appealing CV typically starts to take shape after the first few semesters have passed. Thus, the vast majority of TUMselect students are in higher semesters. Feel free to apply early on: Even if we initially rejected your application, you would be welcome to apply again.

3. Preparation: How can I prepare for the assessment center?

The TUMselect assessment centers are modeled after the assessment centers for highly selective jobs.

Thus, becoming familiar with case studies, brainteasers, quantitative tests, business news, and interview questions that investment banks, multinationals, and strategy consulting firms use to hire analysts, consultants, executive assistants (“Vorstandsassistenz”), and trainees will be helpful.

4. Munich: I am from the Munich campus, may I apply?

Yes, you may. You need to attend several events that typically take place in and around Heilbronn, Frankfurt, and Stuttgart.

We also highly recommend looking into TUMfast, a superb career network in Munich with a focus on accounting.

5. Language skills: I do not speak German; is that a problem?

No.

However, some companies have German language requirements, typically because many of their clients (despite often having very good English skills) do not feel that comfortable speaking English. Thus, you will be a bit limited in the number of TUMselect events you may attend.

6. Obligations: Do I need to meet any expectations after I have been accepted to TUMselect?

Yes.

1) You need to be an active member (which takes less than a full day in your first semester after joining TUMselect, and up to 2 hours in each subsequent semester, unless you are abroad).

2) You need to continue to perform well academically (you do not need to precisely maintain or even improve your already excellent grade point average, but you still need to be well above average).

3) You may not engage in academic misconduct or any activity detrimental to TUMselect.

7. Reapply: May I reapply again after being rejected before?

Yes.

B. For companies

8. We are already a renowned company: Why should we join?

There are several reasons.

Many industry leaders join TUMselect, because they want to build a connection with the most promising students early on to maintain their leadership position in the long run.

Further, renowned firms are often known for one typical job profile (e.g., mechanical engineers in car companies or marketing experts in consumer goods firms) and thus face difficulties drawing applicants for other very interesting openings in their firms (e.g., IT or business analytics positions).

9. Requirements: What are the requirements for being a TUMselect partner company?

The typical TUMselect company highly values and invests in their human capital and offers interesting jobs for ambitious students.

10. Competition: Will we compete with other employers (or even our direct competitors) for student attention?

No.

In fact, this is one of the (many) attractive features of TUMselect, compared with, for example, job fairs ("Jobmessen"), where firms need to constantly compete for student attention. At TUMselect, you and your company will have plenty of time to meet and build rapport with our top students all by yourselves.

This section offers data on Hofstede, GLOBE, and Schwartz cultural dimensions, the Kogut & Singh (1988) cultural distance index, Ronen & Shenkar (2013) cultural clusters, and the cultural attractiveness index:

CULTURAL DIMENSIONS

Hofstede (csv dta) [Hofstede, G. 2001. Culture's consequences: Comparing values, behaviors, institutions and organizations across nations. Sage: Thousand Oaks, CA.]

GLOBE (csv dta) [House, R. J., Hanges, P. J., Javidan, M., Dorfman, P., & Gupta, V. 2004. Culture, Leadership, and Organizations: The GLOBE Study of 62 Societies. Sage: Thousand Oaks, CA.]

Schwartz (readme) [Schwartz, S. H. 2006. A theory of cultural value orientations: Explication and applications. Comparative Sociology, 5: 137–182.]

Tightness-looseness (csv dta) [Gelfand, M. J., Raver, J. L., Nishii, L., Leslie, L. M., Lun, J., Lim, B. C., Duan, L., Almaliach, A., Ang, S., Arnadottir, J., & Aycan, Z. 2011. Differences between tight and loose cultures: A 33-nation study. Science, 332: 1100–1104.]

CULTURAL DISTANCE, CULTURAL CLUSTERS, & CULTURAL ATTRACTIVENESS

Kogut & Singh (1988) index (csv dta) [Kogut, B., & Singh, H. 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19(3): 411–432.]

Ronen & Shenkar (2013) clusters (csv dta) [Ronen, S., & Shenkar, O. 2013. Mapping world cultures: Cluster formation, sources and implications. Journal of International Business Studies, 44(9): 867–897.]

Cultural attractiveness (csv dta) [Li, C., Brodbeck, F. C., Shenkar, O., Ponzi, L., & Fisch, J. H. 2017. Embracing the foreign: Cultural attractiveness and international strategy. Strategic Management Journal, 38(4): 950–971.]

Notes: Country names are from the World Bank. There are widely used datasets with errors on the internet for download. We tried to identify and correct the errors here. Nevertheless, please double-check the data for consistency before using them.

Delios, A., et al. (2025). The insights from the crowd: Drawing inferences from many approaches to key empirical questions in international business, Journal of International Business Studies, 56(9): 1102–1124.

Loch, C., & Li, C. (2024). Editorial Statement—Engagement and Practice Impact Editor Mission, Management Science, 71(1): vii.

Li, C., Luo, Y., Bu, J., & Tang, Y. (2023). The role of networks in international acquisition premiums, Journal of International Business Studies, 54(9): 1700–1711.

Li, C., Anh, J., Bu, J., & Meyer, K. (2023). The value of publishing in JIBS, Journal of International Business Studies, 54(9): 1688–1699.

Bu, J., Tang, Y., Luo, Y., & Li, C. (2023). Learning from inbound foreign acquisitions for outbound expansion by emerging market MNEs, Journal of International Business Studies, 54(5): 852–886.

Batsakis, G., Theoharakis, V., Li, C., & Konara, P. (2023). Internationalization and digitalization: Their differing role on grocer and non-grocer retailer performance, Journal of Retailing, 99(3): 400–419.

Li., C. (2023). Cultural friction in international joint ventures: Whose cultural distance affects market reactions? Journal of Management, 49(7): 2288–2317.

Li, C., & Haleblian, J. (2022). The influence of nation-level institutions on acquisition premiums: A cross-country comparative study, Journal of Management, 48(8): 878–904.

Li., C., & Gelfand, M. J. (2022). The influence of cultural tightness-looseness on cross-border acquisition performance, Journal of Economic Behavior & Organization, 195: 1–15.

Li, C., & Reuer, J. R. (2022). The impact of corruption on market reactions to international strategic alliances, Journal of International Business Studies, 53(1): 187–202.

Li, C., Shenkar, O., Newburry, W., & Tang, Y. (2021). How country reputation differentials influence market reaction to international acquisitions, Journal of Management Studies, 58(6): 1609–1639.

Meyer, K. E., Li, C., & Schotter, A. P. J. (2020). Managing the MNE subsidiary: Advancing a multi-level and dynamic research agenda, Journal of International Business Studies, 51(4): 538–576.

Li, C., Arikan, I., Shenkar, O., & Arikan, A. (2020). The impact of country-dyadic conflicts on market reaction to cross-border acquisitions, Journal of International Business Studies, 51(3): 299–325.

Gelfand, M. Gordon, S., Li, C., Choi, V., & Prokopowicz, P. (2018). One reason mergers fail: the two cultures aren’t compatible, Harvard Business Review, October.

Li, C., Isidor, R., Dau, L. A., & Kabst, R. (2018). The more the merrier? Immigrant share and entrepreneurial activities. Entrepreneurship Theory and Practice, 42(5): 698-733.

Li, C., Brodbeck, F. C., Shenkar, O., Ponzi, L., & Fisch, J. H. (2017). Embracing the foreign: Cultural attractiveness and international strategy. Strategic Management Journal, 38(4): 950–971.

Bildungscampus 9

74076 Heilbronn